|

|

|

| 1. INTRODUCTION |

1.1 To add little spice to an otherwise mundane subject of " accounts for medical profession" let us rename the topic as " Taxation and Accounts for medical professionals"

1.2 I would hasten to add that this article. Would only give the reader a basic guidance. Professional advice must be sought in the event of any confusion or complex issues that may arise.

1.3 As the most respected profession, it is imperative that doctors must plan their affairs in a manner that would not only be commensurate to the life style they enjoy but also be able to withstand scrutiny from various external agencies like Income Tax, Banks, Consulates etc.

|

| 2. Why maintain accounts |

Top |

|

2.1 To draw an analogy with medical profession -the need to maintain accounts is as important as the need to take patient's history. As patients history help the doctor to arrive at proper diagnosis accounts helps to arrive at doctor's state of financial health. It helps in deriving the income to be declared in the income tax return.

2.2 The Income - tax Act makes it mandatory for medical professionals to maintain books of account in a manner, which will enables the Income - tax Officer to compute the income as per the provisions of the Income Tax Act. Non maintenance of books of accounts could attract a penalty of Rs. 25,000.

2.3 If gross receipts from the professional practice exceed Rs. 10 lakhs during the financial year the books of accounts maintained will have to be audited by Chartered Accountant. Chartered Accountant's report along with various prescribed particulars will have to be filed with the Income -tax department along with the return of Income. If you fail to get your accounts audited and filed with the return of Income, you are liable to attract a penalty of1/2 % gross receipts subject to maximum of Rs. 1,00,000..

2.4 Books of accounts: The basic set of books all professional are required to maintain are:

a. Cash Book -for recording cash receipts and cash payments.

b. Bank Book - for recording payments through bank, receipts by cheque and cash deposited and withdrawn from bank.

c. Journal - for recording transactions that do not affect cash and cheque. Depreciation and other rectifying entries are passed through journal.

d. Ledger - it records all the transactions of the cash, bank and journal account head wise.

e. Daily case Register - all medical professional are required to maintain this register in the prescribed Form No.3C.

f. All supporting documents namely bank statements; bills, etc are required to be maintained.

|

| 3. Method of Accounting |

Top |

|

3.1 Majority of doctors follow "Cash System" of accounting. Cash system of accounting means to account for only those income and expense, which are actually received or paid For e.g. Telephone expenses for the month of March 05, which is normally paid in April 05, will not form part of the expenses claimed in year Ending 31. 03.2005. Similarly Professional Fees received in April 2005 of Bill raised in March 2005 will also not form part of the income the income for the Year Ending 31.03.2005

3.2 The other system of accounting is "mercantile System" wherein one accounts for receivables and payables, which at the end of the year. Under Mercantile System of accounting, the Telephone Expenses and professional Fees mentioned here would form part of the expenses and income respectively for the year ending 31.03.2005.

|

|

4.1 In Income Tax parlance we call it is the status of the assesses. Your tax

Status could be Individual, Hindu Undivided Family, Partnership, and Company

(Public or Private) or a trust .One may undertake the professional activity

as an Individual or in the form of partnership or a Company (corporate).

certain professional bodies prevent partnership between a member of that

professional body and a nonmember. For e.g a Chartered Accountant cannot

enter into partnership with a non -chartered accountant and practice .

Similarly Doctors need to check up with their professional body to ascertain

whether they can enter into partnership with a non doctor.

4.2 In order to decide under which status one needs to carry on the business ,you

need to consult be your Tax Consultant.In case the capital requirement is large

it is advisable to go in for a Company .All the members of the family and friends

can contribute towards the capital by subscribing to equity shares of the

company . The advantage of forming a company is that all the shareholders

can share the profits of forming in case the company declares dividend.

The business does not get disturbed in the event of changes in the ownership

Pattern unlike in partnership .Banks are more comfortable lending long term

loans to a company rather than to a partnership or an individual. Most of the

new hospitals in Mumbai are owned by companies in which several doctors

and their friends and relatives have stake. Several old hospitals in Mumbai

from income tax. But several rules and regulations need to be strictly are exempted to continue to enjoy income tax exemption.

|

| 5. Nature of activity and nature of Income |

Top |

|

5.1 The nature of service rendered will determine the nature of income for

Income Tax purpose .If you are a general practitioner or a consultant the

Nature of a your income will be categorized as professional fees. If you are

attached to a hospital or any such institution you will receive the income in

the nature of consulting fees or such operation /surgery fees, which can be

also classified as professional fees

5.2 If you are running a nursing home or a hospital, the income of the said

nursing home/ hospital will be treated business income which is distinct

from professional income. The gross receipt limit for the purpose of audit

would then be Rs 40 lakhs instead of Rs 10 lakhs.

5.3 If you are attached either full time or part time as employee with a

Hospital or with an educational institution as a professor/lecturer/dean the

Earnings will be classified as salary income.

5.4 If your income comprises the nature mentioned in 5.1 and 5.2, you are

required to maintain proper books of accounts. However, if your income

comprises the nature mentioned in 5.3 ,you are statutorily not required to

maintain the books of accounts.

5.5 if is however, always advisable to maintain books of accounts whether

Statutorily required or not. It helps in keeping proper track of transactions

entered into.

|

|

Para 5 detailed the income earned by you from your professional practices/ business and salary. Over and above these two heads of income, you may also have "Income From property", "Capital Gains" and Income from Other Sources". Thus there are following five heads of income under which your income will be classified when you file your returns of income with income-tax authorities:

6.1 Salary Income: Income earned, as an employee will be included under this head.

6.2 Income Business / Profession: Income earned, as a consultant, general practitioner or profit of a nursing/ hospital of which you are proprietor will be included under this head.

6.3 Income from Property: Income derived by way of rent will be included under this head. In case you own the premises from which your spouse runs the establishment if any rent is received by you it will be included under this head.

6.4 Capital Gains: Gain / Loss on sale of movable and immoveable assets are taxed under this head. Such assets & Properties are classified as long terms & Short Term asset based on the period for which it is held. The nature of asset & period of holding will determine its taxability.

6.5 Income from Other Source: It is residual head, which includes income in the nature of interest, dividends (if not tax- free) investment income(NSC Interest, Kisan Vikas Patra interest, P.O. Savings MIS interest, Bank interest etc. Expenses incurred for earning such income are allowed as deductions from the income.

|

|

7.1 Expenses incurred for running the business/ profession is normally allowed as an expenditure for the purpose of calculating profits / losses

7.2 Normal expenses which can be claimed in income tax are as follows :-

a. Cost of medicine consumed

b. Cost of consumables like bandages, needles, syringes etc.

c. Salary and Bonus to staff

d. Stipend / professional fees to assistant doctors

e. Rent paid for premises

f. Insurance Premium (on equipments & professional indemnity)

g. Maintenance expenses

h. Electricity Expenses

i. Telephone Expenses

j. Interest On loans

k. Lease charges

l. Conveyance / Vehicle expenses

m. Seminar & conference fees

n. Foreign Travel Expense (for attending Seminars & conferences)

7.3 It must be clearly understand that the above expense must be incurred for

the purpose of profession / business. Any expenses which can be regarded

as personal in nature may be disallowed for e.g. rent for residential premises, residential electricity, interest on loan taken for personal use etc.

|

| 8. Concept Of Depreciation |

Top |

|

8.1 Depletion in value of asset due to and efflux of time is called Depreciation.

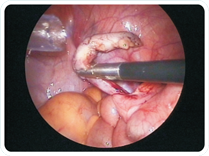

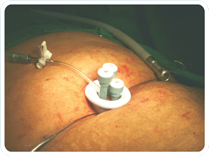

8.2 Each asset carries a specified rate of depreciation specified under the Income Tax Act. For the year ending 31.03.2006 the depreciation rates are: machines such as X-Ray, Sonography, Blood Pressure measuring, instrument etc. carry 15% rate, Certain life saving equipments like Heart Lung Machine, Colour Doppler, Surgical laser, Bone Marrow Transplant equipment, Laparoscope etc. depreciation of 40% Motor car carry 15 % rate, Building premises carry 10 % rate, furniture carry 15 % rate and Computer including software @60%.

8.3 If the asset is acquired during the first half of the year i.e. used for more than

180 days, full depreciation will be allowed else half of the actual depreciation will be allowed. Thus asset purchased and used before 30th September will be allowed only half the depreciation. Any assets acquired and put to use even on the last date will entitle you to claim depreciation at half the normal rate.

|

| 9. Expenses Not allowable |

Top |

|

Following expenses even if incurred and debited to the Profit & Loss Account are to be added back for the purpose of calculating Net Profit of the Profession / business .

i. Fine , Penalty paid for violation of any law

ii. Illegal expenses like bribes etc.

iii. Donations

iv. Unreasonable payments to specified relatives.

v. Expenses exceeding Rs 20,000 incurred in cash otherwise than by account payee cheque will be disallowed to the extent of 20%

vi. Any duty, cess, tax or statutory payment not actually paid on or before the due date of filling of the return if mercantile system of accounting is allowed .

vii. Any expenses on which tax was required to be deducted at source but not

Deducted.

|

|

i. Maintain accounts on regular basis; do not keep it's a year-end activity.

ii. Maintain two separate bank accounts. One for professional and other

for personal transactions

iii . Deposits cash receipts in the bank instead of directly cash expireses.

Iv. Withdraw cash regularly for professional expenses and personal use.

v . Your personal use withdrawals should be commensurate with your standard of living, place of residence, number of members in the family. Pay your society maintenance, household electricity, home phone, college / school fess by cheque.

vi. As far as possible pay all professional expenses by cheque.

Vii. Preserve all records of at least 6 years prior to the current year.

viii . Visit your tax consultant before the end of the year to ensure timely corrective measure.

|

| 11. Planning your income |

Top |

|

i Gifts: The finance Act 2004 amended the provision relating to receipts of money without consideration, which in simple parlance would mean Gift. Such receipts exceeding Rs 25,000 during the year would now attract Income Tax. However gifts from relatives would not be subjected to Income Tax. Gifts to minor can be an effective tool for creating wealth of the minors and also increasing the income of the minors. Such income would be clubbed along with the income of the parent. However if income earned by minor, which is exempt in nature like PPF Interest, Long Term Capital Gains on sell of Share would in no way increase the tax liability of the parent. Income from capital built up through gifts would not be clubbed in the hands of the parent after the minor reaches the age of majority i.e. 18 years.

ii Long Term Capital Gains: Time your decision to sell after checking the period of your holding of shares or equity oriented mutual funds. It may so happen that the shares that you have sold was held for just little less than a year and you would end up paying 10% Short Term Gain. However if held for short time more could have led to your holding the shares for a year or more and entire gain would not have been subjected to tax. Please note that the capital gain exemption is only if shares of a listed company is hels for more than a year and on which Security Transaction Tax is paid when it is sold. In respect of sale of other assets such as residential house there is no exemption unless the sale of proceeds are invested in specified assets. For an immoveable property to become long term the period of its holding is stipulated as more than 3 years.

iii Interest on Housing Loan: The biggest benefit available in the form of deduction from the income is interest on housing loan upto 1.50 lakhs per annum. It is not necessary that such loan is taken and interest is paid to a housing finance company, bank or an employer. It could be from any relative or any other person. Considering the present rate of interest at 8%,one individual can borrow upto Rs. 20 lakhs and claim interest deduction upto maximum limit of Rs 1.50 lakhs. If a bigger loan is to be availed it is better to take it in the name of the spouse by making him/her a joint owner of the property. The spouse can avail of a fresh limit of interest deduction of Rs 1.50 lakhs.

iv HUF as tax entity : Income Tax act recognizes Hindu Undivided Family as a separate tax entity. The benefit of basic exemption limit of Rs 1,00,000 can be availed and so also all other rebates and deductions available to an individual assessee. The individual must explore the possibilities of augmenting the capital of the HUF. The options available are- making an appropriate provision in the HUF - partition of the bigger HUF- gifts etc. professional advice can be sought on this issue.

v. In house sharing of income: Let us consider how an optimum tax planning done by a family can save income tax for the YE 31.03.2006:

| |

Mr. A

Rs

|

Mrs. A

Rs |

Mrs. A

Rs |

Total

Rs |

| Gross Total Income |

2,50,000 |

2,50,000 |

2,00,000 |

7,00,000 |

| Less: deduction |

|

|

|

|

| u/s 80C* 80CCC** |

1,00,000 |

1,00,000 |

1,00,000 |

|

| U/s 80D ( Mediclaim) |

10,000 |

5,000 |

|

|

| Total Income |

1,40,000 |

1,45,000 |

100,000 |

|

| Income Tax |

4,080 |

1,020 |

Nil |

5,100 |

*it comprises payments of LIC premium, PF Contribution, PPF, NSc Investment, Tuition fess, installment for repayment of housing loan taken from a housing finance company, bank, employer, certain prescribed schemes of mutual funds etc.

**it comprises payment by an individual to keep in force a contract for any annuity plan of LIC or any other insurer for receiving pension from the fund.

Please note the Finance Minister in his speech had mentioned about taxing the 80C deductions as and when an withdrawn or money is received back or disinvested. However the same is still under consideration. As and when it becomes a law the investment under this section will only lead to deferment of tax and not a permanent tax saving.

Total Income tax paid by the family is less than 1% of the gross total income

The net cash surplus in the hands of the family after investment, mediclaim and payment of taxes will be Rs 379,000 more than Rs 30,000 p. m

|

| 12. Planning through Will |

Top |

|

Through execution of a will, a person can ensure that his legal heirs avail of tax benefits after his death. While executing his will the parent would like to distribute his proprieties amongst his / her children. In such cases if the taxable income of children is kept in mind the beneficiaries of the will can be HUF of the sons or the spouses of the children or grandchildren. Through professional advice tax planning through creation of discretionary trust under the Will can also be done. At present India does not have an estate duty.

|

| 13. BASIC INFORMATION ALL MUST KNOW |

Top |

|

13.1 Due Dates: In case of an assesee who does not have business or professional income the due date of filling income tax return is 31st July. Incase of all other assessee it is 31st October. Filling of return after due date will attract penalty of Rs.5000/-. Incase you have incurred a loss of the same can be carried forward and set off against next years income provided you have filed the loss return within the due dates mentioned. The due dates for payment of Advance tax are 15th September, 15th December, 15th March. Incase of a Company, the first installment of advance tax fails due on 15th June. You ought to pay atleast 90% (including TDS ) by way of tax before 15th march to avoid paying interest.

13.2 Permanent Account Number: Every tax payer need to have a PAN.

It is a ten character number allotted by the Income Tax which is mandatory to be quoted incase you are registering a property, buying a car, depositing cash in excess of Rs 25,000 etc.

13.3 Accounting Year & assessment Year: The Accounting Year is the year beginning on 1st April and ending on 31st March. The Assessment Year commences 1st April and end of the Accounting Year. Thus for the Accounting year 1st April 2005 to 31st March 2006 , the assessment year is 2006-07

13.4 Tax Deduction at Source : TDS is important responsibility of a tax payer. All tax payers except an individual or An HUF (unless tax audit ) are required to deduct tax at source from payments made in respect of salary, professional fees, rent, contract payment, interest etc. there are different threshold limits for deductions in each case. Non deduction of tax at source would result in that particular expense for which tax was required to be deducted to be disallowed. Thus proper care must be taken to ensure that tax is correctly deducted at source. Each tax payer must obtain Tax Deduction Account Number (TAN) and files TDS Returns.

13.5 Fringe Benefit Tax: The Finance Act 2005 has introduced this new tax. The benefits given to employees which are not taxed in the hands of the employee would be covered under FBT. Thus Expenses like conveyance, traveling, sales promotion, entertainment, telephone, motor car expenses including depreciation etc would be subjected to FBT at 33.6% on 20 % of such expenses. Certain expenses will bear FBT on 50% of such expenses on festival celebrations, gifts, scholarship, use of club facilities etc.

13.6 Banking Cash Transaction Tax (BCTT) : The Finance Act 2005 has introduced this new tax. Tax will be levied at 0.1% of the amount withdrawn on a single day exceeding the specified limit from an account other than saving account as follows:

By an Individual / HUF Rs. 25,000

By other than an Individual / HUF Rs. 100,000

Similarly proceeds received in cash on single day on maturity of term deposits exceeds the limits mentioned above will also be subjected to BCTT. Withdrawals from saving account of any amount will not attract BCTT.

|

|

As you caution your patients to not to indulge in self medication since it could be life threatening, so also you should not indulge in self tax planning your financial affairs as it could be injurious to your finances.

Financial discipline is must to lead a healthy life. In order that a person could lead a tension free life, the role of tax & financial consultant is as important, if not more, as medical consultant.

. Tax planning and accounting is a specialty by itself, and needs professional advice.

. Financial well being of doctor should be reflected in his balance sheet

. A doctor must understand the need to build his capital right from the beginning his career.

. Maintaining books of accounts and getting if applicable for every medical professional

. Maintain accounts in a regular basis, do not keep it as a year end activity

. Basic knowledge of tax planning is mandatory for every doctor.

|

|

|